Health insurance is a type of insurance that helps protect against the risks of health conditions. It can help cover the costs of things like examinations, diagnosis, treatment, and psychological and physical support. In some cases, it can also help cover the cost of interruptions to your plans.

Introduction

Health insurance is a type of insurance that helps to cover the costs of medical care. It can help to pay for things like exams, diagnosis, and treatment, as well as psychological and physical support. Health insurance can come from a variety of sources, such as the government, employers, or private companies. It is important to have health insurance in order to get the care you need and to protect yourself financially in case of an unexpected health event.

What is health insurance?

Health insurance is a type of insurance that helps cover the costs of medical care. It can help pay for things like doctor visits, hospital stays, and medication. Health insurance can also help pay for mental health services and addiction treatment. There are different types of health insurance, but all plans typically have some kind of monthly premium, annual deductible, and out-of-pocket maximum.

The different types of health insurance

There are many different types of health insurance available to individuals and companies. Health insurance can cover the costs of medical examinations, diagnosis, treatment, and psychological and physical support. It may also include coverage for interruption of work due to illness or injury. Group health insurance plans are available from many different insurers, and they can be customized to meet the needs of the group. Car insurance is another type of insurance that covers the risks of collision, overturning, and theft.

The benefits of having health insurance

The philosophy of health insurance is based on the principle of collecting the risks that afflict society and the costs of treatment, which leads to the lack of access to health care and the deterioration of health. Health insurance is a way to protect yourself from high medical bills. It is a contract between you and an insurance company. You agree to pay premiums, and the company agrees to pay for some or all of your medical expenses if you get sick or hurt.

There are many types of health insurance plans. Some plans cover only certain types of medical expenses, such as hospitalization or surgery. Other plans cover most types of medical care, including doctor visits, prescription drugs, mental health care, and more. Some plans have annual limits on how much they will pay out for your care. Others have no limits at all.

Health insurance can be very expensive. The cost of premiums, deductibles, and co-pays can add up quickly. But there are ways

Who is eligible for health insurance?

Health insurance is a type of insurance that helps to protect against the risks of health conditions. It can help to cover the costs of exams, diagnosis, treatment, and psychological and physical support. There are many different types of health insurance, and each has different eligibility requirements. To be eligible for health insurance, you must meet the requirements of the specific type of insurance you are applying for.

How to apply for health insurance?

If you need help applying for Medicaid or the Medicare Savings Program, you can get assistance from a government-funded health insurance marketplace. In order to get help, you will need to submit an application and provide some personal information. Once you have submitted your application, a representative will be able to help you determine if you are eligible for coverage.

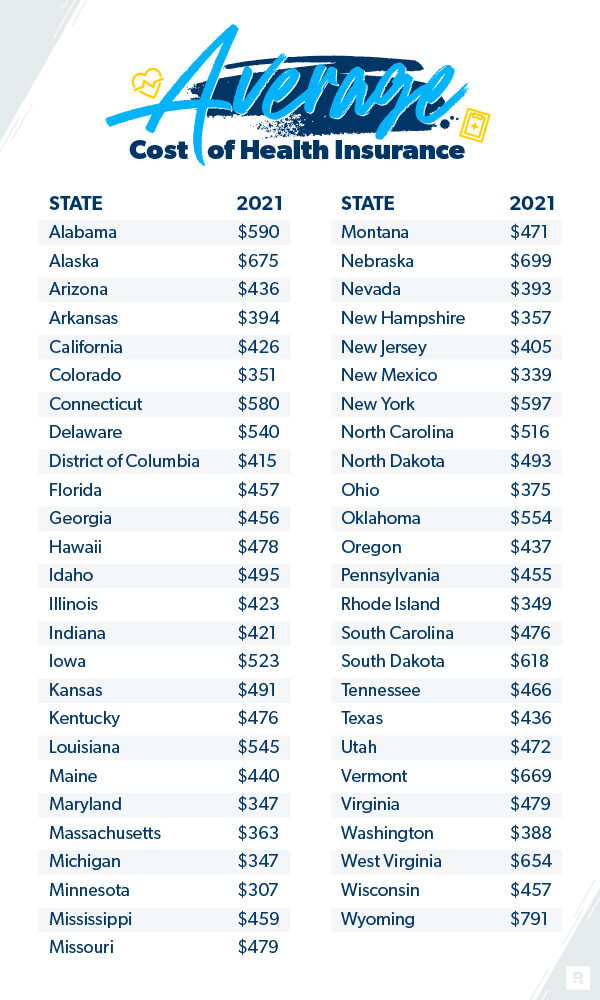

How much does health insurance cost?

How much does health insurance cost? The cost of medical insurance varies according to gender, age, medical history and geographic scope. The cooperative offers many insurance programs. How much does health insurance cost per person per month? Its price starts at 21.25 dinars and ends with a limit of 120 dinars per month. It depends a lot on your age, gender and current state of health. What are the features of health insurance extracted from our company? It is valid in a number of private hospitals. It covers the costs of operations in hospitals, but after its extraction for a period of time

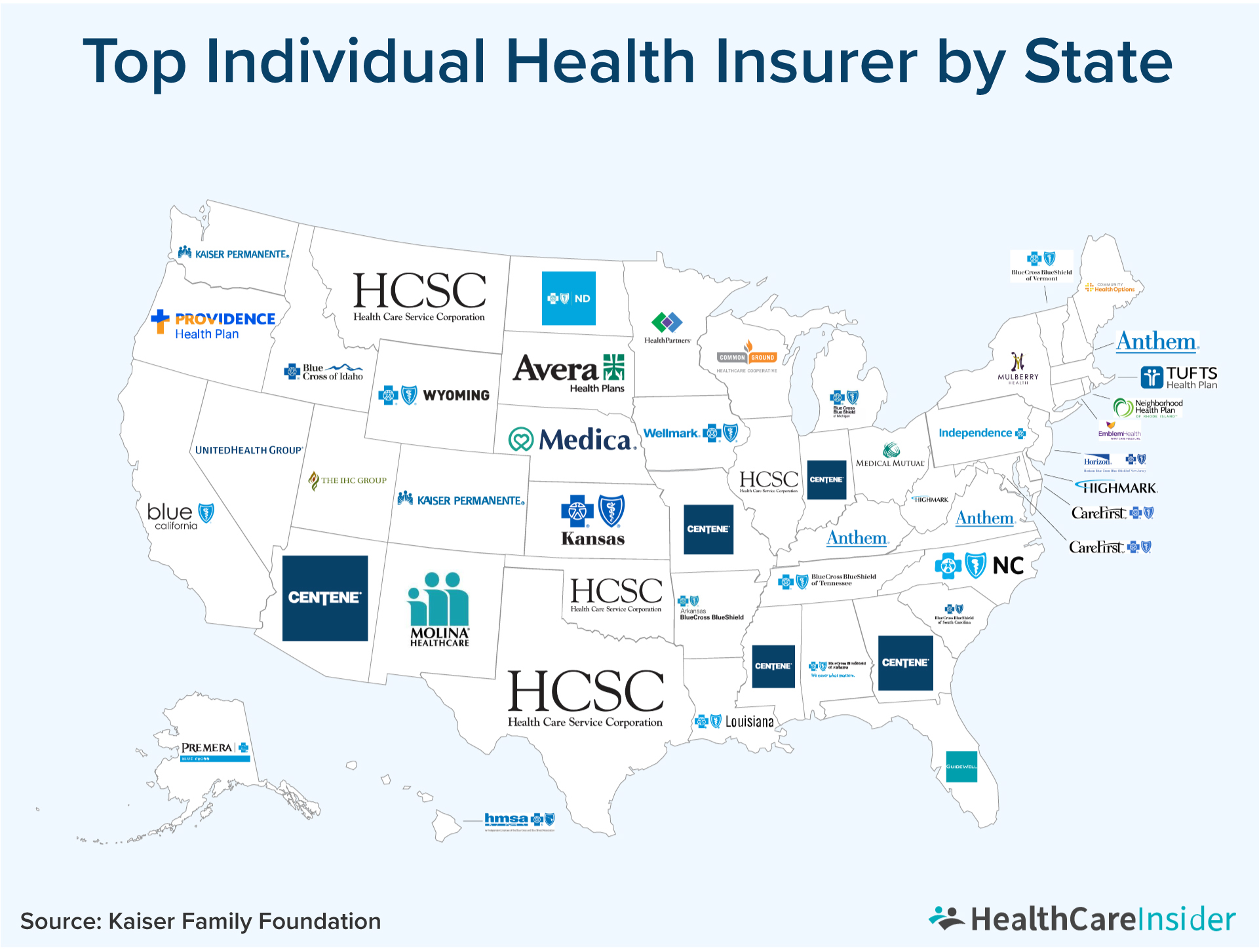

What are the different health insurance providers in the market?

There are many health insurance providers in the market. The Saudi insurance market is one of the health care service providers. In this issue, we introduced a definition of one of the health care service providers, which is the clearing of money, the development of insurance legislation. It is “the agreement under which the insurance company assumes the responsibility to cover the risks, private or facultative insurances, which include the various types of insurance that the person has.

They told "Emirates Today" that the "Corona" pandemic highlighted some changes in the health insurance market in various markets of the world, noting that the costs announced by some companies to add a new case to its subscribers have been increasing lately.

Daman Health Insurance Company Dubai was established in 2006 with the aim of building a healthy community, providing its services to more than 3 million subscribers in various cities of the UAE.

The Abu Dhabi government, through the Thiqa

Comments

Post a Comment